GBP/USD showed more bullish bias on Wednesday, which was triggered by weak US reports. The market, already reluctant to buy the dollar, eagerly rushed to sell it. However, in most cases, we observe either flat movement or very low volatility. Over the past 9-12 months, flat segments have occupied approximately 70-80% of all time and all trades. Therefore, it is difficult to trade the pair since it shows weak movement.

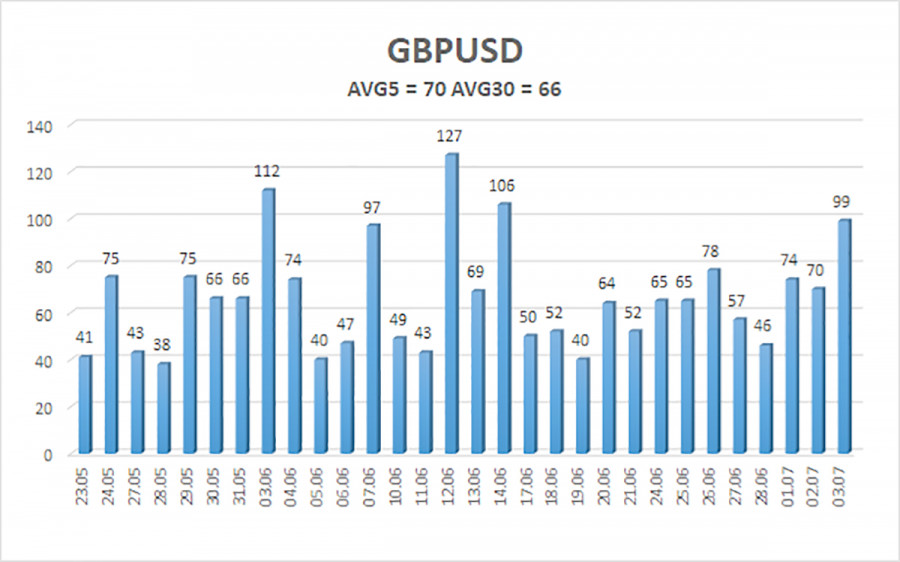

This week, there were very few macroeconomic events in the UK. However, there were enough in the US. Yes, some reports triggered a minor market reaction, but we will draw your attention to volatility indicators. We are not urging anyone to trade or not to trade. We are merely pointing out that even for the British pound, the average volatility is currently 66 pips. Traders should understand that this number does not indicate a daily movement of 66 pips. In 5 out of the last 12 days, volatility did not exceed 60 pips. And again, just a head's up, this is not about a movement of 60 pips from point "A" to point "B," but rather about the maximum price change for the day – from the low to the high. Individual movements within the day are much weaker.

In general, the market is not ready to trade under any circumstances. For instance, this week Federal Reserve Chair Jerome Powell gave a speech in which he reiterated that the central bank is in no hurry to lower the key interest rate. Powell said that the American economy remains strong, and the labor market is stable. Therefore, the US central bank has enough time to simply wait for inflation to start approaching the Fed's target level. In our opinion, this is a hawkish stance. If Powell is talking about not rushing to ease monetary policy at the beginning of July, it is unlikely that we will see the first rate cut in September. However, it also did not happen in March or June. The market simply keeps pushing the expectations of the first cut a few months forward when it realizes that the next "optimistic" forecast will not come true. And the fact that the Fed has maintained its hawkish policy, much longer than expected at the end of last year and which was the basis for the pound's active growth and refusal to fall, no longer has any effect on the GBP/USD pair.

Interestingly, for comparison, we looked at articles from a year ago to see what volatility was like at that time. The average volatility on June 26, 2023, for the pound was 90-100 pips. Several months before that, it was 110 pips. 110 pips per day over the last 30 working days. The current 66 pips is almost half that.

From a technical perspective, we now have a new round of upward movement, which absolutely contradicts the global technical picture. However, the market chooses to either remain flat or eagerly buy the pound for any reason.

The average volatility of GBP/USD over the last five trading days is 70 pips. This is considered an average value for the pair. Today, we expect GBP/USD to move within a range bounded by the levels of 1.2682 and 1.2822. The higher linear regression channel is pointing upwards, which suggests that the upward trend will continue. The CCI indicator entered the overbought and oversold areas recently.

Nearest support levels:

S1 - 1.2726

S2 - 1.2695

S3 - 1.2665

Nearest resistance levels:

R1 - 1.2756

R2 - 1.2787

R3 - 1.2817

Trading Recommendations:

The GBP/USD pair has once again consolidated above the moving average line. In recent weeks, the price has been trading flat and is constantly changing direction. After consolidating below the moving average line and overcoming the area of 1.2680-1.2695, the pound has better chances of falling further, but the market is not in a hurry to sell. Traders should be cautious with any positions on the British currency. There is still no reason to buy it, and it is also risky to sell, because the market ignored the fundamental and macroeconomic background for two months, and refused to sell the pair for the same period. From our perspective, traders may consider short positions with targets of 1.2604 and 1.2573, if we are talking about a logical and natural movement. However, the pound is not even able to correct lower.

Explanation of Illustrations:

- Linear Regression Channels – Helps determine the current trend. If both are directed in the same direction, it means the trend is currently strong.

- Moving Average Line (settings 20.0, smoothed) – Determines the short-term trend and the direction in which trading should currently be conducted.

- Murray Levels – Target levels for movements and corrections.

- Volatility Levels (red lines) – The probable price channel in which the pair will spend the next day, based on current volatility indicators.